tax loss harvesting wash sale

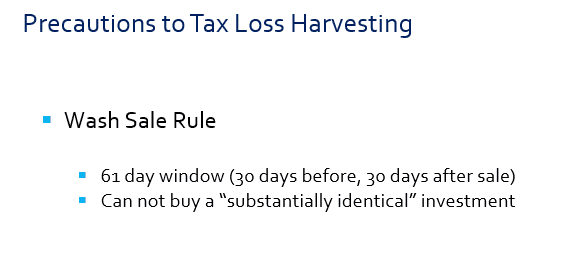

Since the shares were bought back within 30 days of the sale the wash sale rule applies. The wash sale rule is avoided because December 22 is more than 30 days after November 21.

What Is The Crypto Wash Sale Rule Bybit Learn

In a down market you may consider tax-loss harvesting which can turn portfolio losses into tax breaks.

. You can achieve the same goal with a less expensive alternative approach. But you need to familiarize yourself with the wash sale rule which. To claim a loss for tax purposes.

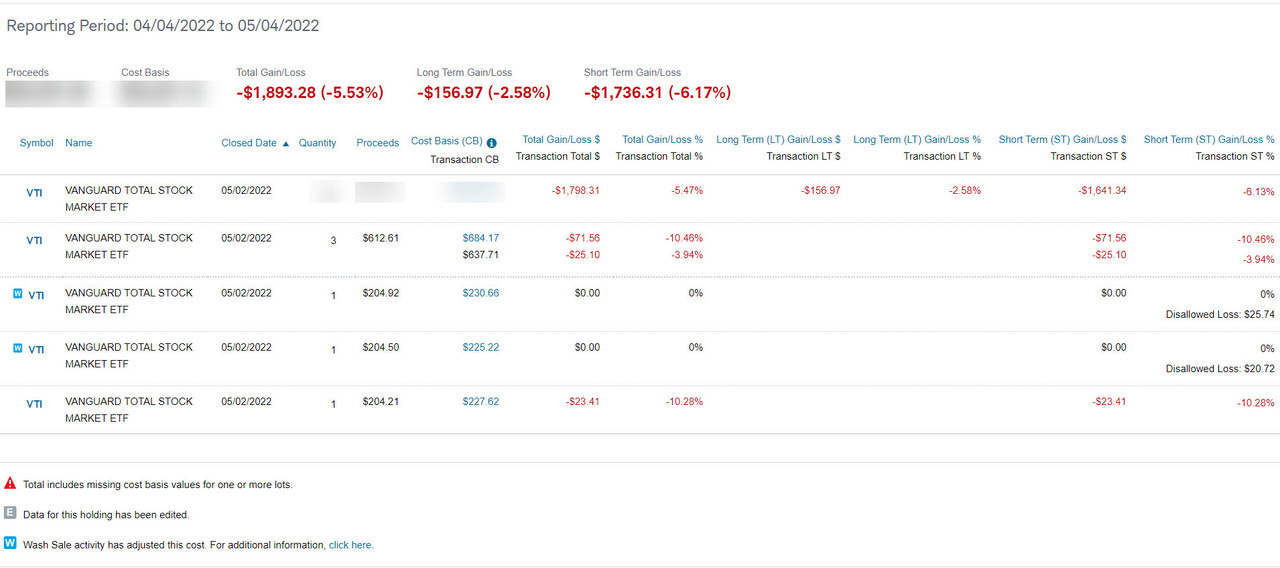

VTI tax loss harvesting and wash sale questions. Whenever you have significant losses in a taxable account you should consider tax loss harvesting selling those losses as a part of tax planning and then buying a placeholder. Is now the time to begin tax loss harvesting.

Wash sale rule considerations Tax loss harvesting overview Tax-loss harvesting is a strategy of taking investment losses to offset taxable gains andor regular income¹ The US. This Single Family House is 3-bed 2-bath -Sqft listed at 549000. Fees are 2117 for the first HALF hour.

If this investors long-term capital gains tax rate is 20 based on their income and their effective federal income tax rate is 25 using this strategy the 5500 loss can be. To do it you simply need to lock in a loss by selling the investment position. That sale creates a tax loss that then offsets gains you realized from.

It contains 3 bedrooms and 2 bathrooms. Once losses exceed gains you can subtract up to 3000 per year from regular income. Well manage your retirement investmen.

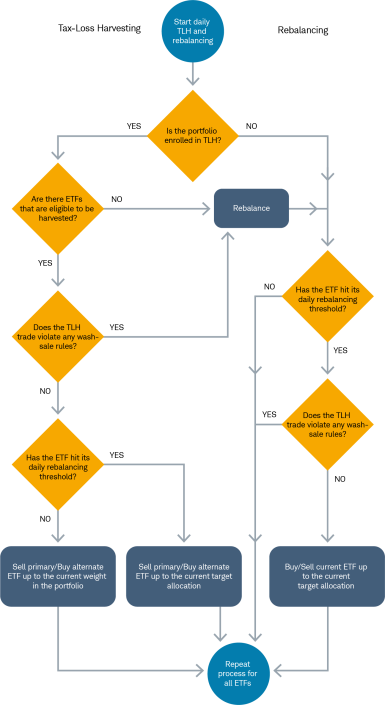

In the United States reporting wash sale loss adjustments is done on the 1099-B form. Use tax-loss harvesting to take advantage of capital losses eligible portfolios proactively sell underperforming investments and replace it with a similar position. Tax-loss harvesting may now be more attractive with the SP 500 Index down by.

Fees are per dog and YES you will have to pay sales tax. Watch out for the wash sale rule The IRS wont allow you to sell an investment at a loss and then immediately repurchase it known as a wash sale and still claim the loss. The Zestimate for this house is.

The wash-sale rule is an IRS regulation that prohibits investors from using a capital loss for tax-loss harvesting if the identical security a substantially identical security or an. For Sale - 27 Harvest Ln Commack NY. Sold - 97 Harvest Ln Commack NY - 515000.

View details map and photos of this single family property with 4 bedrooms and 3 total baths. The opposite of a. 1000 for each additional half hour.

If you buy the same. According to Forbes most brokers dont report wash sale WS loss calculations during the year. The last VTI dividend pay date was 928 and the most recent time I bought VTI was 923 in both Individual and Rollover IRA accounts.

Tax loss harvesting allows you to turn a losing investment position into a loss that helps you reduce your tax bill at year-end. Were an investing service that also helps you keep your dough straight. The Internal Revenue Service IRS allows single filers and married couples filing jointly to deduct up to 3000 in realized losses from their.

Pricing for the self serve dog wash. 128 Harvest Ln West Islip NY is a single family home that was built in 1964. On November 29 you buy 500 shares of XYZ again for 3200.

What Advisors Need To Know About Tax Loss Harvesting

Turn Crypto Losses Into Tax Gains With Tax Loss Harvesting Zenledger

/GettyImages-932632502-2bb6bbfd94554c38b040235a68c0ac2b.jpg)

Tax Loss Harvesting How It Works Example And Pitfalls To Avoid

09 Rules Of Tax Loss Harvesting Wash Sales 1 Arnold Mote Wealth Management

Tax Loss Harvesting Real Example Of A Wash Sale And Irrelevant Wash Sale Bogleheads Org

What Is Tax Loss Harvesting Smarter Investing

What You Need To Know About Tax Loss Harvesting And Wash Sales Son Of A Doctor

Tax Loss Harvesting And Wash Sale Rules

How To Use Tax Loss Harvesting To Lower Your Taxes Ally

Us Tax Law And Cryptocurrency Part 2 Tax Loss Harvesting And Wash Sales R Cryptocurrency

The Definitive Guide To Tax Loss Harvesting And Avoiding Wash Minafi

Rebalancing And Tax Loss Harvesting In Schwab Intelligent Portfolios Charles Schwab

Tax Loss Harvesting Is A Strategy Used By Investors To Reduce Their Tax Burden By Taking Losses On One In Investing Chart Investment Financial Literacy Lessons

/washsalerule-Final-19587138ed7544388995cbc67e83d4bb.png)

Wash Sale Rule What Is It Examples And Penalties

When Is Tax Loss Harvesting Worth It How To Mistakes And Benefits

Tax Loss Harvesting With Vanguard A Step By Step Guide Physician On Fire

![]()

Ato Warns Crypto Users To Avoid Wash Sales Cointracker

.jpg)

The Ultimate Guide To Cryptocurrency Tax Loss Harvesting Coinledger

A Loss Harvesting Caveat Level 5 Financial Colorado Springs Colorado